ct sales tax exemptions

Sims 4 luxury cc ucla tuition fees. States provide various exemptions from sales or use tax such as an exemption for goods purchased for resale or materials or machinery and equipment purchased for use in.

Assessment Of Sales Tax On Labor In The State Of Ct Sapling

Exact tax amount may vary for different items.

. Health Care Provider User Fees. 7 on certain luxury motor vehicles jewelry clothing and footwear. A sales tax is a tax levied on the sale of specific products and services that is paid to a tax authority by the seller but charged from the buyer of.

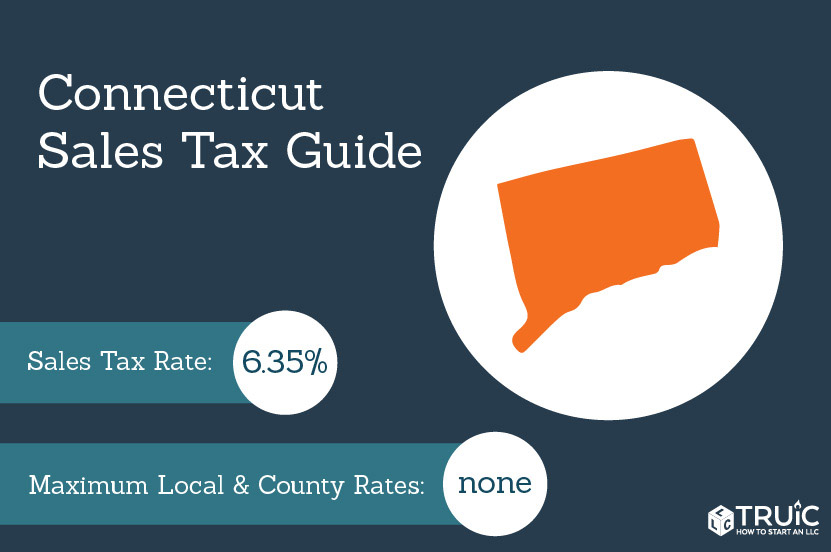

Nov 11 2021 Purpose. Due to high call volume call agents cannot check the status of your application. Beginning on the July 1st 2011 the state of Connecticut levies a 635 state sales tax on the retail sale lease or rental of most goods.

Rental Surcharge Annual Report. Jun 21 2022 Connecticut Sales Tax. For tax exemption you must present a valid Farmers Tax.

Dry Cleaning Establishment Form. This vehicle is exempt from the 635 Connecticut salesuse tax if its used directly in the agricultural production process. See Special Notice 201851 Legislative Changes Affecting.

There are exceptions to the 635 sales and use tax rate for certain goods and services. There are exceptions to the 635 sales and use tax rate for certain goods and services. Agile Consulting Groups sales tax consultants can be.

What is Exempt From Sales Tax In Connecticut. 44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut. Connecticut State Department of Revenue Services IMPORTANT INFORMATION - the following tax types are now available in myconneCT.

Individual Income Tax Attorney Occupational Tax. A sales and use tax rate of 299 applies to the sale of vessels motors for vessels and trailers used for transporting a vessel. Find out more about the available tax exemptions on film video and broadcast productions in Connecticut.

Manufacturing and Biotech Sales and Use. An organization that was issued a federal Determination Letter of. You can learn more by visiting the sales tax information website at wwwctgov.

The Connecticut Sales Tax is administered by the Connecticut Department of Revenue Services. Ct sales tax exemptions. As with all Sales Use Tax research the specifics of each case need to be considered when determining taxability.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. Exemption from sales tax for services. 7 on certain luxury motor vehicles boats jewelry clothing and.

2022 Connecticut state sales tax. A Summary of Connecticut sales tax CT. This Informational Publication describes two sales and use tax exemptions for purchases and leases of fuel-efficient passenger motor vehicles.

Manufacturing and Biotech Sales and Use Tax Exemption See if your. How to use sales tax exemption certificates in Connecticut. Page 1 of 1.

The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is. Sales of child car. Factors determining effective date thereof.

For a complete list of exemptions from Connecticut sales taxes refer to Conn. Exemption from sales tax for items purchased with federal food stamp coupons. Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations.

FilmTVDigital Media Tax Exemptions Find out more about the available tax exemptions on film video and broadcast productions in Connecticut.

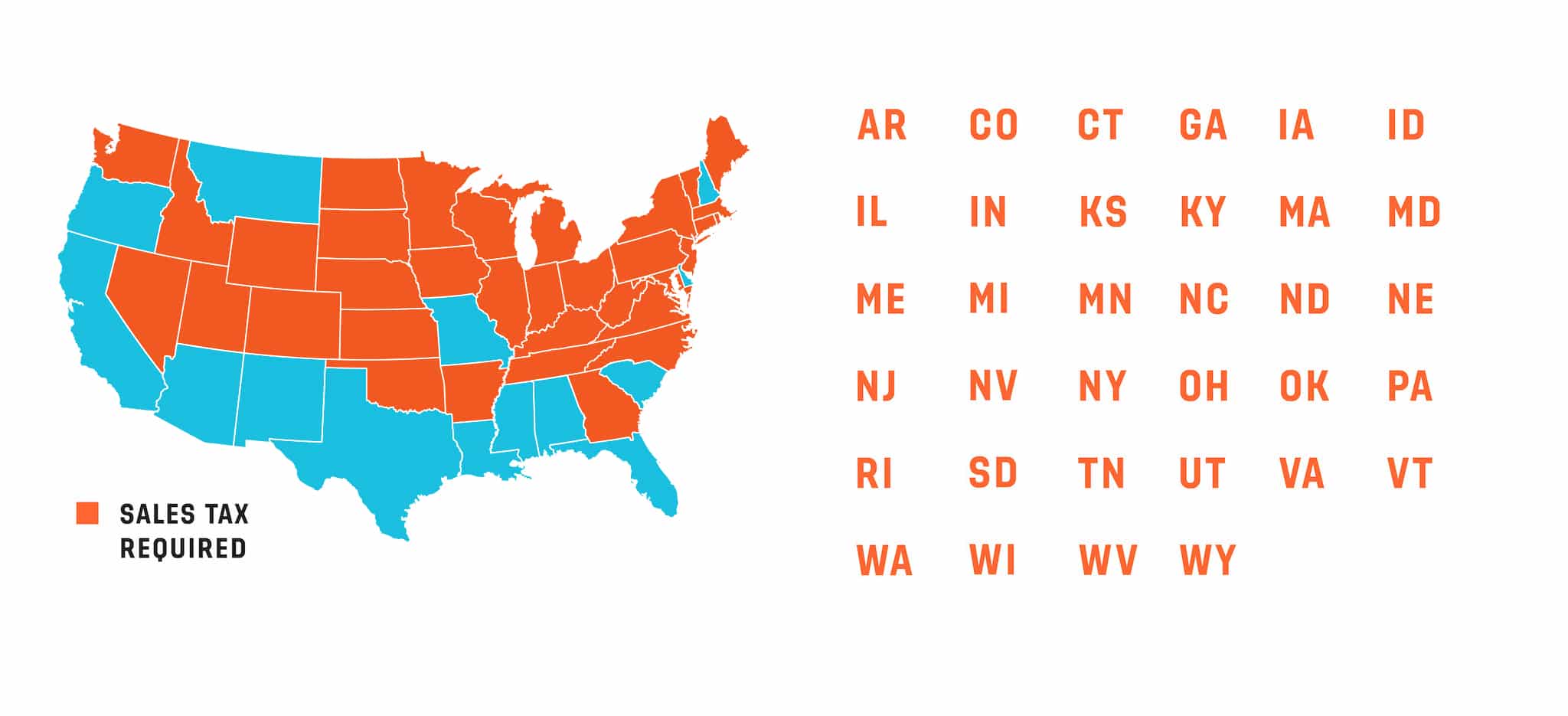

State By State Guide To Economic Nexus Laws

Connecticut Sales Tax Small Business Guide Truic

Fairfield Retailers Look Forward To Ct Tax Free Week Experience Fairfield Ct

Sales Tax Exemptions And Native Americans Avalara

Connecticut Consumers Won T Pay Tax On Some Items For A Week

Connecticut State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Sales Tax Holidays The Cpa Journal

Tax Free Shopping Usa What Will Be Exempt From Ct Sales Marca

How To File And Pay Sales Tax In Connecticut Taxvalet

Connecticut Ct Tax Exempt On Your Mark

Form Ct 3 B Tax Exempt Domestic International Sales Corporation Disc Information Return

Connecticut Military And Veterans Benefits The Official Army Benefits Website

Form Cert 141 Fillable Contractors Exempt Purchase Certificate

Form Cert 126 Fillable Exempt Purchases Of Tangible Personal Property For Low And Moderate Income Housing Facilities